attribution habits & ML automation

I recently chatted with Depesh Mandalia from AdSignals about our use of Machine Learning to help...

Based in Maryland, Traders Reserve is a financial publisher that provides educational and advisory products to investors.

Founders David Durham and John Hutchinson observed first-hand how many investors struggled with trading services that overpromised but under-delivered.

They formed Traders Reserve with the goal of delivering “best in class” financial advice and trading services.

Together they bring over 45 years of experience to the company, having worked with some of the largest financial publishers in the country.

Traders Reserve uses Ontraport — a business automation software — for CRM and to handle customer orders. They market their products with Google and Facebook Ads.

Traders Reserve offers a wide spectrum of one-time and recurring products across different verticals, but they were struggling to calculate customer lifetime value.

As a result, they couldn’t calculate the true ROI of their marketing campaigns over time or accurately attribute revenue to their customers.

Increased ad spending from $5,000 to $18,000

Generated $300,000 in revenue over 12 months

Generated at least a 10x ROI on ad spend

Traders Reserve was using Ontraport to conduct multi-channel campaigns, but the platform had weak attribution tools. It could only track one-time purchases, not recurring payments (where most of their revenue stems from).

This meant that Traders Reserve was getting inaccurate numbers when trying to track their ad spend revenue.

Before they could scale their campaigns and increase spending on customer acquisition channels, they needed to understand which (if any) of those campaigns were driving positive ROI over the long term.

Traders Reserve utilized Wicked Reports’ attribution models to tie recurring revenue to their clicks, allowing them to see the value of their customers over time.

Like most companies, Traders Reserve understood that they couldn’t scale unless they had accurate data about their marketing campaigns.

They needed to see the full picture to make informed decisions. Otherwise, they would waste their ad spend trying to figure out what worked and what didn’t.

That’s why they chose Wicked Reports.

Wicked Reports is the only solution with industry-leading attribution models that connect first-click and lead generation to your customer's lifetime value.

By attributing recurring revenue, Traders Reserve can identify which ads and campaigns were bringing in the leads that generated their most valuable customers — something they couldn’t do with Ontraport.

With that insight, they were able to scale their winning campaigns and significantly increase their marketing ROI.

"What I saw — and the only reason I saw it was because of Wicked — [was that] the money we first spent in September we had made back by mid-October."

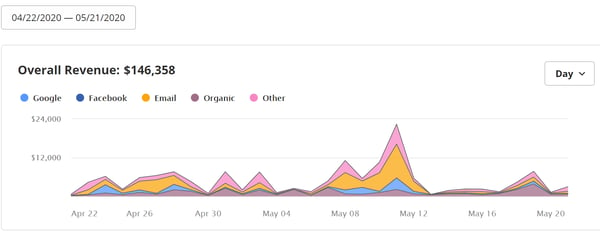

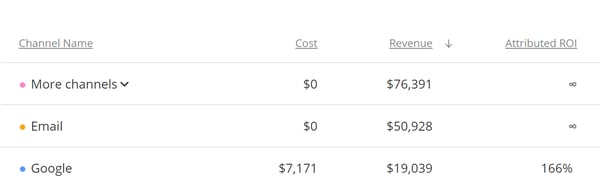

Traders Reserve used Wicked Reports to identify the most valuable channels that generated the highest ROI for their business.

I recently chatted with Depesh Mandalia from AdSignals about our use of Machine Learning to help...